Blog > Make the Right Choice: Renting out property vs. Selling property

Should You Rent or Sell?

Here’s Why More Homeowners Are Choosing to Cash Out Now

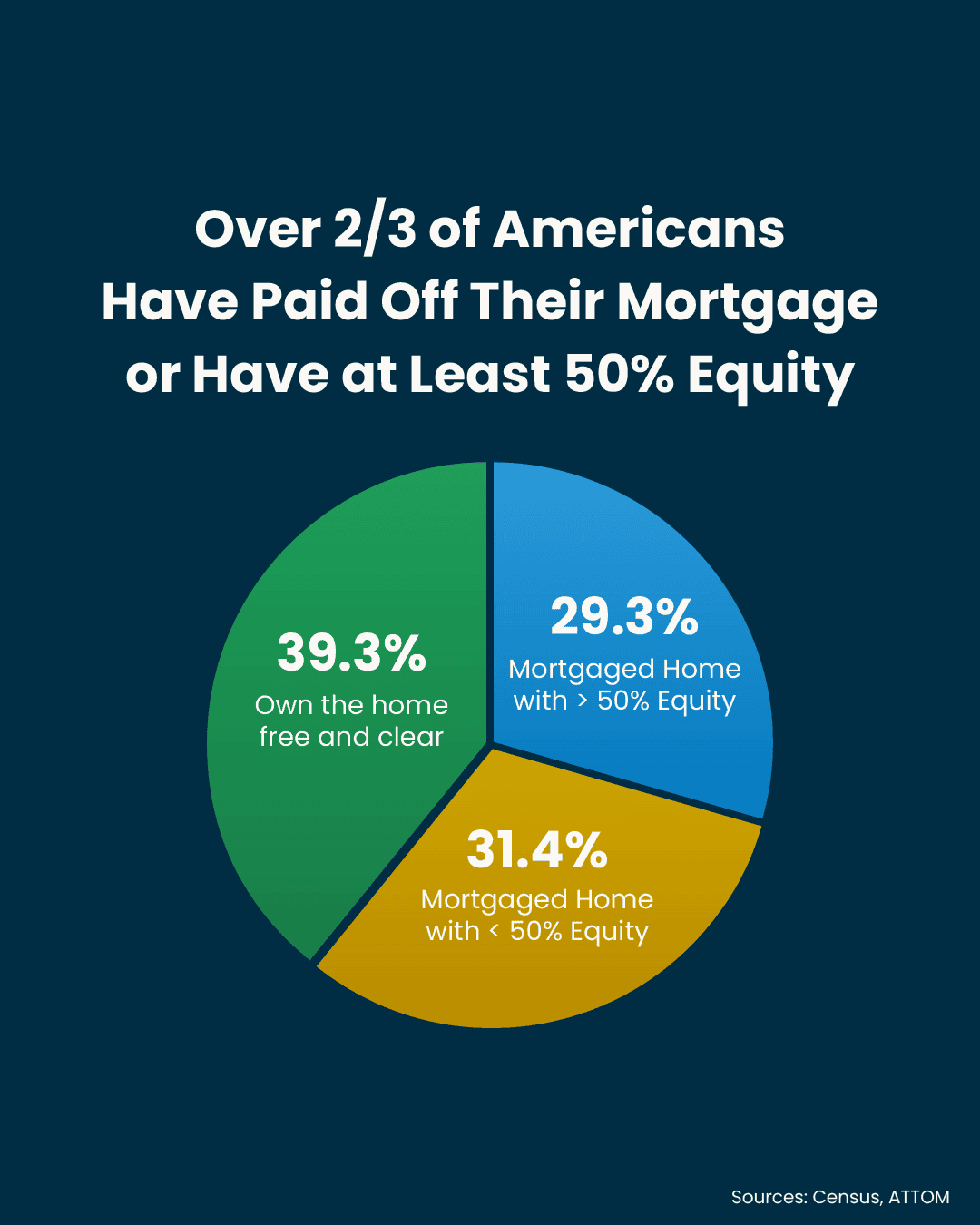

If you’re a homeowner sitting on years of built-up equity, you’re not alone — in fact, American homeowners are sitting on more equity than any previous generation. That’s why many sellers are starting to ask a crucial question: Should I hold onto my home as a rental, or should I sell now and cash out while the market is still in my favor?

With the market shifting and inventory slowly rising, it’s becoming more important than ever to make the right decision at the right time.

Let’s break it down.

The Case for Selling Now

1. You’re Sitting on Record-Breaking Equity

Homeowners today are sitting on a financial goldmine. If you’ve owned your home for several years, chances are you’ve gained hundreds of thousands of dollars in equity. Listing your home now gives you the opportunity to turn that “paper wealth” into real, usable funds — whether that’s for retirement, a move closer to family, travel, or your next dream home.

The longer you wait, the more competitive the market may become — and the less you may ultimately net.

2. The Market Is Starting to Shift

We’re nearing the transition into a buyer’s market. With inventory levels climbing (approaching 6 months of supply in some areas), sellers are starting to lose their upper hand. More listings mean more competition, and that makes it harder to stand out — especially if your home isn’t move-in ready or lacks premium features.

Timing matters. Selling before inventory peaks puts you in a stronger position.

3. We’re in the Prime Selling Season

Late spring and summer are historically the best times to sell. Buyers are active, families want to move before school starts, and relocation activity is at its highest. Homes listed now tend to sell faster and for a higher price — but that window is limited.

“Homes listed toward the end of spring and early summer frequently sell more quickly and at higher sales prices.” – Rocket Mortgage

4. Cashing Out Simplifies Life

Are you planning to downsize, retire, or relocate? Selling now allows you to declutter your finances, avoid landlord headaches, and free up cash to fund your next life chapter — with no strings attached.

What About Renting It Out Instead?

It’s true — holding property long-term can build wealth if you’re in it for 10+ years and if you’re ready for the responsibilities. But here’s what you need to consider:

Being a Landlord Isn’t Passive Income

- Managing a rental comes with ongoing work, stress, and costs. From midnight maintenance calls to late rent payments and tenant turnover, it’s far from passive income. You’ll need to budget for:

- Property management (usually 8–10% of monthly rent)

- Vacancies and tenant screening

- Maintenance and repair costs (expect 1–2% of home value annually)

- Insurance, taxes, and HOA fees

- Long-distance ownership challenges (if you’re relocating)

Monthly Rent May Not Cover Rising Costs

Even in high-demand rental markets, monthly cash flow isn’t guaranteed. High interest rates, increased insurance premiums, and rising taxes can eat into your rental profit quickly — especially if you still have a mortgage.

Who Should Consider Renting Instead?

- Investors with long-term horizons (10+ years)

- Homeowners who can afford to self-manage or live nearby

- Those comfortable riding out market fluctuations and future repairs

If that doesn’t sound like you — or if your life plans involve moving, downsizing, or retiring soon — selling now may be your best move.

Bottom Line: Selling Now May Maximize Your Profit

We’re still in a window of opportunity for sellers. Inventory remains relatively low, demand is steady, and homeowners have unprecedented equity to leverage. But as more properties hit the market and buyer activity shifts, waiting could mean walking away with less.

If you’re unsure, I can walk you through your home’s current value, expected rental performance, and what it would take to sell for top dollar in today’s market.

Sometimes the best investment isn’t holding on — it’s knowing when to cash in.

Ready to explore your options? Let’s chat. I’ll help you make the most informed decision based on your goals, your property, and today’s market conditions. HOME VALUATION